Get your questions answered! Join our monthly open call: LINK HIER EINFÜGEN

Empowering Asset Managers with Data Integration

Streamline data exchange between asset managers with FundsXML, the industry-standard file format that has been revolutionizing the financial industry.

ensures data quality… since 2001

Why FundsXML?

Data Exchange

The open source format FundsXML is revolutionizing the way financial institutions exchange fund data. This open standard facilitates secure and efficient data transfer, empowering institutions to reduce costs, improve operational efficiency, and gain a competitive edge.

Boost Efficiency

FundsXML automates the exchange of fund data, eliminating the need for manual processes prone to errors and delays. This translates into significant time and cost savings, allowing institutions to dedicate resources to more strategic initiatives.

Ensuring Accuracy

Traditional data exchange methods are vulnerable to errors during manual entry. FundsXML eliminates this risk by providing a standardized format and automated transfer, guaranteeing the accuracy and integrity of your data.

Seamless Interoperability

FundsXML transcends limitations imposed by proprietary systems. Its design ensures compatibility with a wide range of platforms, enabling effortless data exchange with various financial institutions.

Cost Savings Through Reusability

Employing a standard format like FundsXML significantly reduces the effort needed for developing and maintaining interfaces. Data structures and processes can be reused, lowering implementation and operational costs.

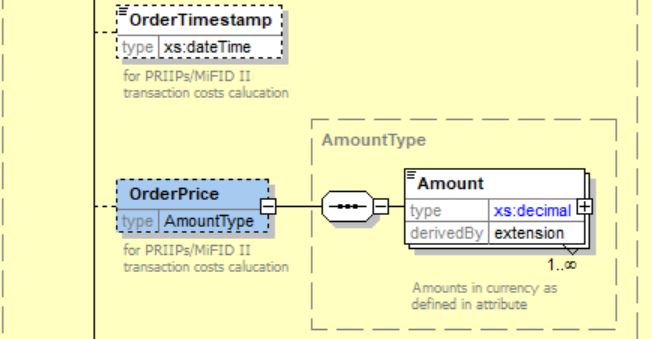

Support for Regulatory Requirements

FundsXML can be used to create regulatory reports, such as those related to PRIIPs (Packaged Retail and Insurance-based Investment Products) or MiFID II (Markets in Financial Instruments Directive II). By leveraging the standard, companies can ensure their data complies with regulatory demands.

Beyond Efficiency: The Power of Standardization

Fund Data Exchange Between Asset Managers and Platforms

Description: FundsXML can be used to transfer detailed information about investment funds from asset managers to fund distribution platforms, ensuring accurate and consistent data delivery.

Key Data: Fund prices, NAVs (Net Asset Values), performance data, portfolio composition, and risk metrics.

Benefit: Streamlines the process of keeping fund platforms updated with accurate data, reducing manual intervention and errors.

Regulatory Reporting

Description: FundsXML simplifies the preparation and submission of regulatory reports, such as those required by PRIIPs, MiFID II, or Solvency II.

Key Data: Key Investor Information Documents (KIIDs), cost structures, risk indicators, and fund-level disclosures.

Benefit: Ensures compliance with regulatory standards by providing a structured format recognized by regulators and reducing administrative overhead.

Custodian and Transfer Agent Communication

Description: FundsXML can be used to share transactional and account-level data between custodians, transfer agents, and fund administrators.

Key Data: Subscription and redemption orders, dividend distributions, and reconciliation data.

Benefit: Enhances operational efficiency by automating and standardizing communication between multiple stakeholders.

Cross-Border Fund Distribution

Description: When distributing funds internationally, FundsXML helps provide standardized data to meet the diverse requirements of different markets and jurisdictions.

Key Data: Legal structures, tax implications, market-specific pricing, and currency details.

Benefit: Simplifies data sharing across borders, reducing complexity and ensuring compliance with local market requirements.

FundsXML was made for…

- Portfolio valuation: FundsXML can be used to aggregate fund data for portfolio valuation.

- Risk analysis: FundsXML can be used to analyze the risk of fund portfolios or performance attribution

- Reporting: FundsXML can be used to generate reports on fund data.

- Compliance: FundsXML can be used to ensure compliance with regulatory requirements.

- Transparency: FundsXML can be used for fund lookthough for various purpose (e.g. ESG, Limit Control and others)

- External Portfolio Management: FundsXML can be used for automatic holdings reconciliation

What our user say…

Latest News

Unveiling the ESAP Technical Standards

The European Single Access Point (ESAP) is a flagship action of EU policymakers for improving…

Version 4.2.4 released

The FundsXML initiative has released a new version of its schema. The updated version 4.2.4…

Join Our Webinar: Navigating Data Challenges

As the financial industry rapidly advances, understanding the nuances of handling data is pivotal. Against…

Need help? Curious? Want to know more?

Get your questions answered!

Ask our community: https://community.fundsxml.org

Get updates.

Join the Mailing List and receive updates and news.